Account Closing

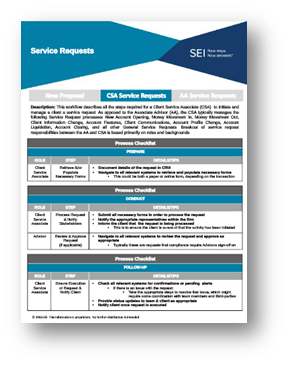

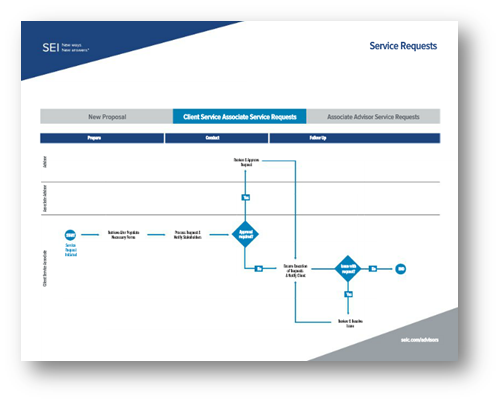

This workflow describes all the steps required for a Client Service Associate (CSA) to initiate and manage a client service request. As opposed to the Associate Advisor (AA), the CSA typically manages the following Service Request processes: New Account Opening, Money Movement In, Money Movement Out, Client Information Change, Account Features, Client Communications, Account Profile Change, Account Liquidation, Account Closing, and all other General Service Requests.

| Manual |

Diagram |

|

|

|

Account Features

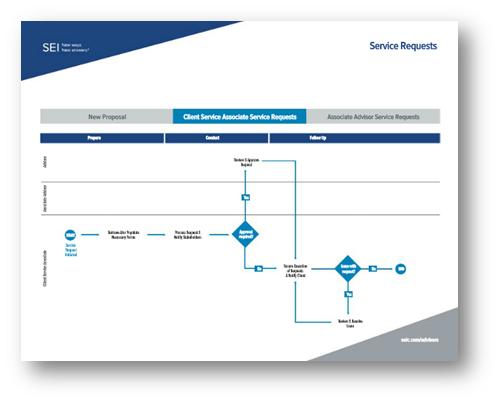

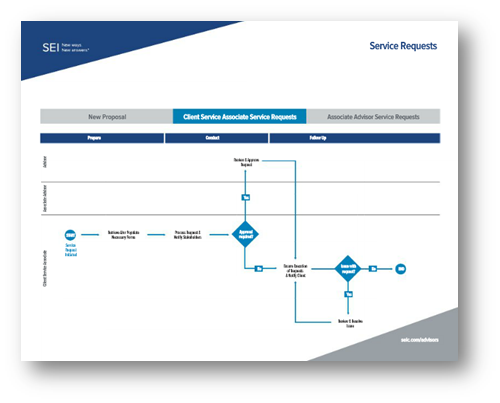

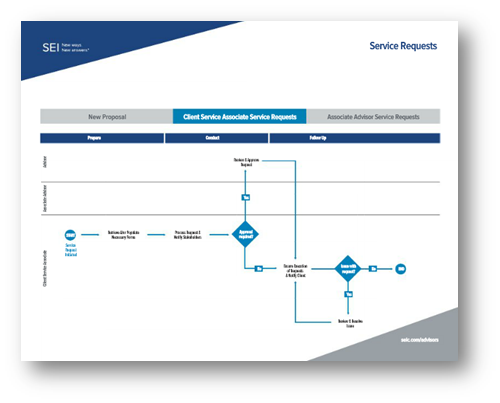

This workflow describes all the steps required for a Client Service Associate (CSA) to initiate and manage a client service request. As opposed to the Associate Advisor (AA), the CSA typically manages the following Service Request processes: New Account Opening, Money Movement In, Money Movement Out, Client Information Change, Account Features, Client Communications, Account Profile Change, Account Liquidation, Account Closing, and all other General Service Requests.

| Manual |

Diagram |

|

|

|

Account Liquidation

This workflow describes all the steps required for a Client Service Associate (CSA) to initiate and manage a client service request. As opposed to the Associate Advisor (AA), the CSA typically manages the following Service Request processes: New Account Opening, Money Movement In, Money Movement Out, Client Information Change, Account Features, Client Communications, Account Profile Change, Account Liquidation, Account Closing, and all other General Service Requests.

| Manual |

Diagram |

|

|

|

Account Profile Change

This workflow describes all the steps required for a Client Service Associate (CSA) to initiate and manage a client service request. As opposed to the Associate Advisor (AA), the CSA typically manages the following Service Request processes: New Account Opening, Money Movement In, Money Movement Out, Client Information Change, Account Features, Client Communications, Account Profile Change, Account Liquidation, Account Closing, and all other General Service Requests.

| Manual |

Diagram |

|

|

|

Client Communications

This workflow describes all the steps required for a Client Service Associate (CSA) to initiate and manage a client service request. As opposed to the Associate Advisor (AA), the CSA typically manages the following Service Request processes: New Account Opening, Money Movement In, Money Movement Out, Client Information Change, Account Features, Client Communications, Account Profile Change, Account Liquidation, Account Closing, and all other General Service Requests.

| Manual |

Diagram |

|

|

|

Client Information Change

This workflow describes all the steps required for a Client Service Associate (CSA) to initiate and manage a client service request. As opposed to the Associate Advisor (AA), the CSA typically manages the following Service Request processes: New Account Opening, Money Movement In, Money Movement Out, Client Information Change, Account Features, Client Communications, Account Profile Change, Account Liquidation, Account Closing, and all other General Service Requests.

| Manual |

Diagram |

|

|

|

Fee Management

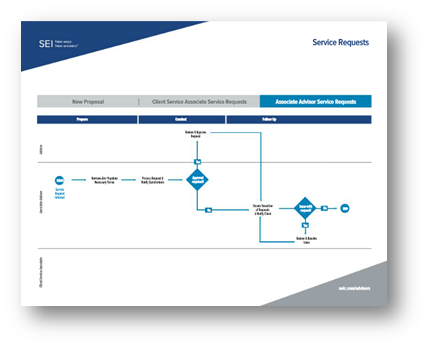

This workflow describes all the steps required for an Associate Advisor (AA) to initiate and manage a client service request. As opposed to the Client Service Associate (CSA), the AA typically manages the following Service Request processes: Strategy Management (Portfolio Level), Fee Management, Trade Requests, and Tax Management.

| Manual |

Diagram |

|

|

|

General Service Requests

This workflow describes all the steps required for a Client Service Associate (CSA) to initiate and manage a client service request. As opposed to the Associate Advisor (AA), the CSA typically manages the following Service Request processes: New Account Opening, Money Movement In, Money Movement Out, Client Information Change, Account Features, Client Communications, Account Profile Change, Account Liquidation, Account Closing, and all other General Service Requests.

| Manual |

Diagram |

|

|

|

Money Movement In

This workflow describes all the steps required for a Client Service Associate (CSA) to initiate and manage a client service request. As opposed to the Associate Advisor (AA), the CSA typically manages the following Service Request processes: New Account Opening, Money Movement In, Money Movement Out, Client Information Change, Account Features, Client Communications, Account Profile Change, Account Liquidation, Account Closing, and all other General Service Requests.

| Manual |

Diagram |

|

|

|

Money Movement Out

This workflow describes all the steps required for a Client Service Associate (CSA) to initiate and manage a client service request. As opposed to the Associate Advisor (AA), the CSA typically manages the following Service Request processes: New Account Opening, Money Movement In, Money Movement Out, Client Information Change, Account Features, Client Communications, Account Profile Change, Account Liquidation, Account Closing, and all other General Service Requests.

| Manual |

Diagram |

|

|

|

New Account Opening

This workflow describes all the steps required for a Client Service Associate (CSA) to initiate and manage a client service request. As opposed to the Associate Advisor (AA), the CSA typically manages the following Service Request processes: New Account Opening, Money Movement In, Money Movement Out, Client Information Change, Account Features, Client Communications, Account Profile Change, Account Liquidation, Account Closing, and all other General Service Requests.

| Manual |

Diagram |

|

|

|

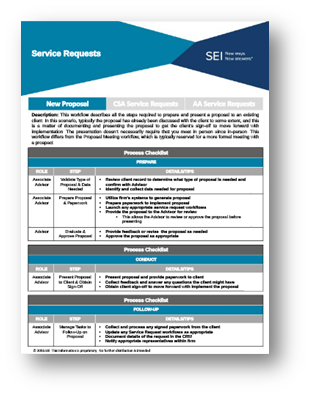

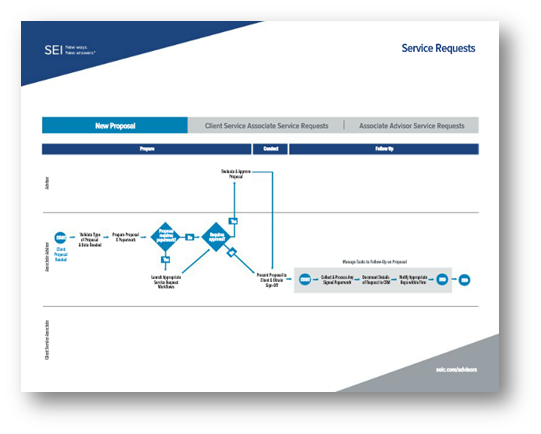

New Proposal

This workflow describes all the steps required to prepare and present a proposal to an existing client. In this scenario, typically the proposal has already been discussed with the client to some extent, and this is a matter of documenting and presenting the proposal to get the client's sign-off to move forward with implementation. This workflow differs from the Proposal Meeting workflow, which is typically reserved for a more formal meeting with a prospect.

| Manual |

Diagram |

|

|

|

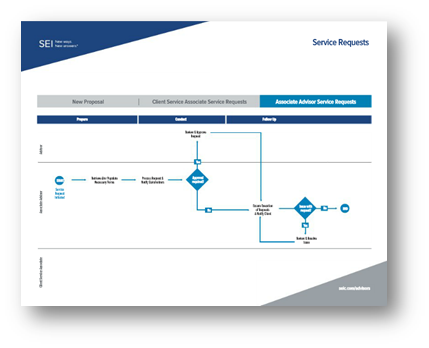

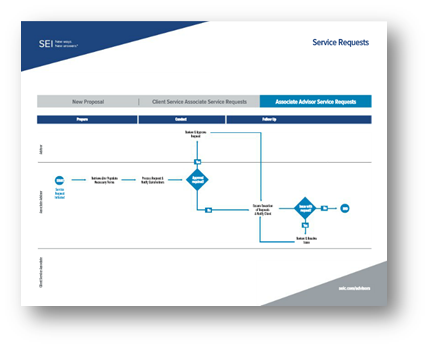

Strategy Management

This workflow describes all the steps required for an Associate Advisor (AA) to initiate and manage a client service request. As opposed to the Client Service Associate (CSA), the AA typically manages the following Service Request processes: Strategy Management (Portfolio Level), Fee Management, Trade Requests, and Tax Management.

| Manual |

Diagram |

|

|

|

Tax Management

This workflow describes all the steps required for an Associate Advisor (AA) to initiate and manage a client service request. As opposed to the Client Service Associate (CSA), the AA typically manages the following Service Request processes: Strategy Management (Portfolio Level), Fee Management, Trade Requests, and Tax Management.

| Manual |

Diagram |

|

|

|

Trade Requests

This workflow describes all the steps required for an Associate Advisor (AA) to initiate and manage a client service request. As opposed to the Client Service Associate (CSA), the AA typically manages the following Service Request processes: Strategy Management (Portfolio Level), Fee Management, Trade Requests, and Tax Management.

| Manual |

Diagram |

|

|

|